2026 Predictions for AECO: AI, Digital Twins, and the Path to Sustainable Transformation

As we step into 2026, the Architecture, Engineering, Construction, and Operations (AECO) industry is poised for a transformative leap. From the integration of AI and digital twins to the adoption of robotics and advanced materials, the sector is embracing innovation to tackle its most pressing challenges: sustainability, efficiency, and collaboration in a hybrid world.

This year’s predictions explore how emerging technologies like generative design, predictive analytics, and automation are reshaping the project lifecycle. We’ll dive into the role of advanced digital tools in achieving net-zero goals, the growing importance of cybersecurity in a connected ecosystem, and the long-term trends that will define the industry for years to come.

In part six of this year’s predictions series, we bring these insights to life with perspectives from Jama Software’s own AECO experts: Joe Gould – Senior Account Executive, and Michelle Solis – Associate Solutions Architect, who share their vision for the future. From AI-driven decision-making to the rise of modular construction and lifecycle optimization, this piece highlights the innovations and strategies that will shape 2026 and beyond.

Curious to read leading thought leaders’ predictions for their industries in 2026 and beyond? Dive into each blog below and stay tuned for part 6, the finale of this year’s series:

- Part One: Consumer Electronics

- Part Two: Medical Devices & Life Sciences

- Part Three: Aerospace & Defense

- Part Four: Automotive

- Part Five: Semiconductors

Emerging Technologies

What specific emerging technologies (e.g., AI, digital twins, generative design, robotics) do you believe will have the most transformative impact on the AECO industry in the next five years? How can firms prepare to adopt and integrate these technologies effectively?

Joe Gould: AI and Machine Learning will become foundational across the entire project lifecycle.

- Design & Planning: AI accelerates generative design by evaluating thousands of options against constraints like cost, performance, and sustainability—helping teams reach optimized solutions faster.

- Predictive Insights: By analyzing large datasets, AI can forecast risks, schedule impacts, cost overruns, and potential failures, enabling earlier and more informed decisions.

- Workflow Automation: Routine tasks such as data entry, document review, and quantity takeoffs are increasingly automated, allowing teams to focus on higher-value, strategic work.

Digital Twins extend these capabilities into operations.

- Operational Optimization: Real-time digital replicas of assets enable continuous monitoring and simulation, improving energy performance, asset utilization, and long-term operating costs.

- Predictive Maintenance: Simulating asset behavior under different conditions helps identify issues before failure, reducing downtime and extending asset life.

- Collaboration: A shared, real-time data environment ensures all stakeholders are aligned on the most current information throughout the asset lifecycle.

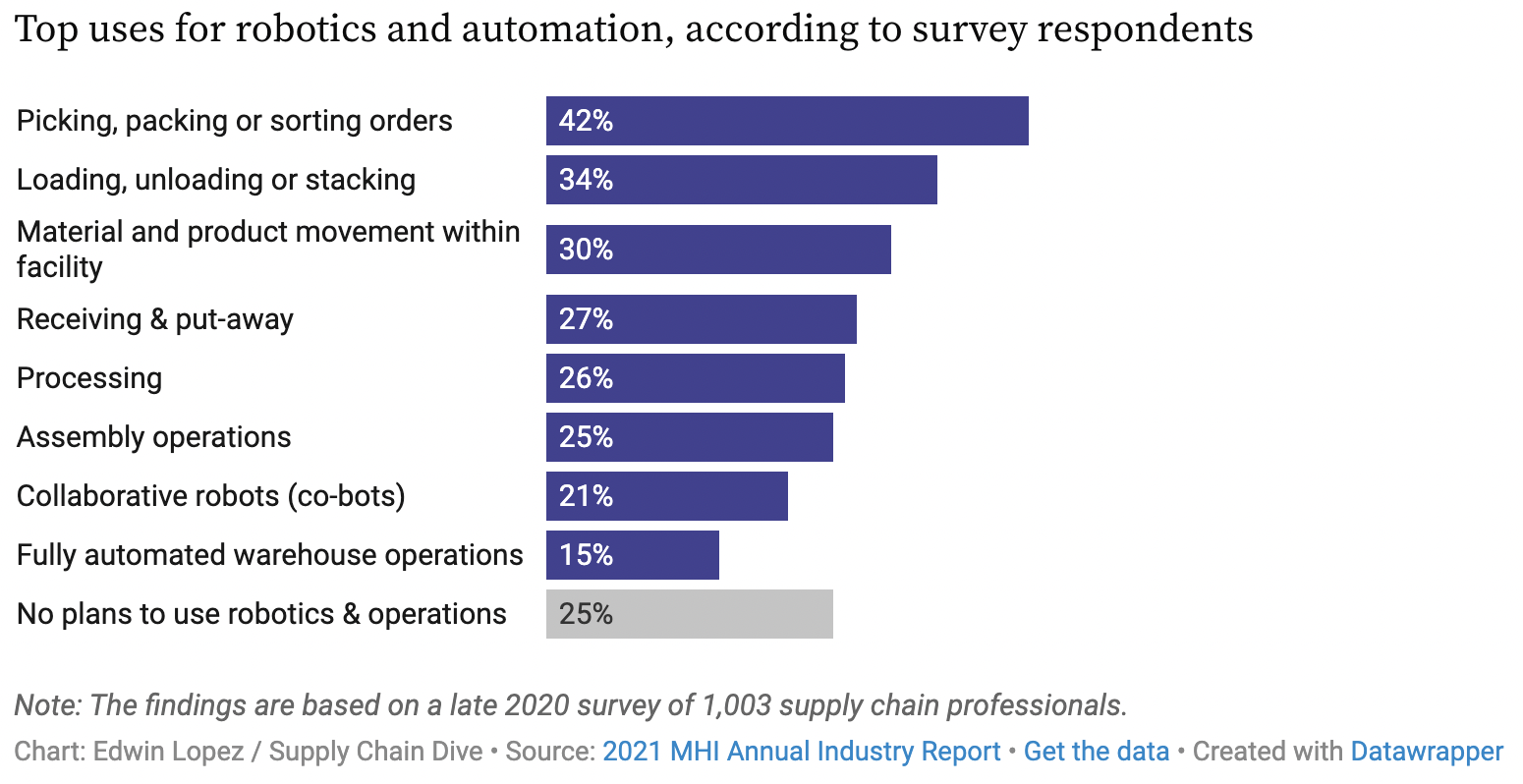

Robotics and Automation have been moving from experimentation to real jobsite adoption.

- On-Site Execution: AI-enabled robotics handle repetitive and high-risk tasks with greater precision and safety.

- Autonomous Equipment: Drones and self-operating machinery are increasingly used for surveying, inspections, and material movement, improving efficiency while reducing labor constraints.

Sustainability and Net-Zero Goals

With the AECO industry under increasing pressure to meet sustainability and net-zero targets, what role do you see advanced software, materials innovation, and digital tools playing in achieving these goals? Are there specific technologies or strategies you think will lead the way?

Gould: Important question! Advanced digital tools allow teams to understand and manage environmental impact early in the process, long before construction begins.

At the core is Building Information Modeling (BIM), which provides a data-rich model that supports ongoing analysis of energy performance, material use, and constructability as designs evolve. Energy modeling and simulation extend this by forecasting real-world performance early, allowing teams to optimize efficiency and integrate renewables before decisions are locked in.

AI and machine learning add another layer by analyzing large datasets to improve decision-making, optimize resources, and surface risks earlier. Generative design helps teams evaluate thousands of design options that balance sustainability, cost, and performance. Digital twins, fed by real-time sensor data, carry this forward into operations—enabling predictive maintenance, smarter energy management, and continuous performance optimization over the life of the asset.

Life-cycle assessment tools tie it all together by informing material choices based on embodied carbon and long-term environmental impact, not just upfront cost.

Materials innovation focuses on reducing embodied carbon and supporting a more circular approach to construction.

This includes a shift toward low-carbon materials such as mass timber, green steel, and advanced concrete alternatives, along with greater use of recycled and reusable content. High-performance insulation and composites further improve operational efficiency by reducing long-term energy demand while maintaining durability and performance.

The real impact comes from integrating these tools into a single, data-driven approach—connecting design, construction, and operations.

Key strategies:

- Data-driven decarbonization, using reliable project data for transparent reporting and continuous optimization

- Prefabrication and modular construction, reducing waste, emissions, and schedule risk

- Circular design principles, enabling reuse and recovery at end of life

- Predictive maintenance, extending asset life and reducing long-term operational waste

By aligning digital tools, materials innovation, and lifecycle thinking, the industry can move beyond incremental gains and make measurable progress toward net-zero and long-term sustainability goals.

RELATED: Best Practices Guide to Requirements & Requirements Management

Collaboration in a Hybrid World

As hybrid and remote work models continue to evolve, how do you see these changes impacting collaboration, innovation, and project delivery in the AECO industry? What tools or processes will be critical for maintaining efficiency and creativity?

Gould: Hybrid and remote work are reshaping AECO, driving efficiency, expanding access to talent, and accelerating digital adoption—but they require more discipline around how teams collaborate and deliver work.

Collaboration has shifted from informal to intentional. Cloud-based platforms, shared models, and virtual design reviews are now standard, enabling distributed teams to stay aligned without being co-located. Innovation hasn’t slowed—it’s evolved. Access to broader talent pools and increased automation of routine tasks allow teams to spend more time on higher-value problem-solving.

From a delivery standpoint, hybrid models often reduce cycle times and costs. Work continues across time zones, travel is minimized, and documentation improves because communication has to be clearer by default.

Success in this environment depends less on tools alone and more on how they’re used. Cloud BIM, collaboration platforms, and project management systems form the backbone, but clear communication norms, standardized workflows, and outcome-based accountability are what keep teams productive.

To me, the shift isn’t about where people work—it’s about building repeatable, digital-first processes that support speed, clarity, and consistent project outcomes.

AI and Automation

How do you foresee AI and machine learning shaping decision-making, risk management, and project optimization in AECO? What are the biggest challenges or limitations the industry might face in scaling these technologies to automate processes?

Michelle Solis: While AI itself will make an impact on AECO companies, one additional area where we will see impact is in building the infostructure to handle the increase of AI usage across all industries. This will mean more jobs, job sites, data centers, and projects.

Gould: AI and machine learning are shifting AECO from reactive to proactive. When applied well, they improve decision-making, surface risk earlier, and optimize how projects are planned, built, and operated.

AI helps teams make better decisions by analyzing large volumes of historical and real-time data—highlighting patterns and risks humans typically miss. Generative design accelerates this by evaluating thousands of options against constraints like cost, performance, and sustainability. On the risk side, predictive analytics and real-time monitoring help identify schedule, cost, and safety issues before they escalate. AI also drives operational gains through task automation, smarter maintenance planning, and more resilient supply chains.

The challenge isn’t the technology—it’s scaling it. Most AECO firms struggle with fragmented data, limited system integration, and inconsistent standards. There are also a real skills gap and natural resistance to changing long-standing workflows. Add in high upfront costs, unclear use cases, unclear ROI, and legitimate concerns around data privacy and accountability, and adoption slows quickly.

The opportunity is real, but success depends on getting the fundamentals right: clean data, integrated systems, clear ownership, and practical use cases that tie directly to project and business outcome

Responsible AI Adoption

As AI and machine learning become more integrated into AECO workflows, what challenges or considerations should companies be mindful of to ensure successful implementation? How can firms address these challenges while maximizing the benefits of these technologies?

Gould: AI adoption in AECO isn’t a technology problem—it’s a fundamentals problem. Success depends on data, people, and how firms manage change.

Most organizations struggle with fragmented data, legacy systems, and limited AI-ready skills. Add natural resistance to new workflows, unclear ROI, and concerns around data security and accountability, and progress stalls quickly.

The path forward is straightforward:

- Get the data right: standardize, govern it, and make it accessible

- Upskill teams: treat AI as a productivity multiplier, not a replacement

- Start small: focus on high-impact pilots that prove value fast

- Modernize platforms: move toward cloud-based, integrated systems

- Keep humans in the loop: clear ownership, transparency, and oversight matter

Firms that focus on these basics will scale AI effectively—and turn experimentation into measurable business outcomes.

Data-Driven Project Management

With the growing emphasis on predictive analytics, real-time monitoring, and data-driven decision-making, what strategies would you recommend for AECO firms to better harness data for optimizing project outcomes and resource allocation?

Gould: To use data effectively, AECO firms need to focus less on dashboards and more on fundamentals: integrated systems, clean data, and teams that actually trust and use it.

That starts with moving off siloed tools and spreadsheets and into cloud-based, integrated platforms that create a single source of truth across design, delivery, and operations. Strong data governance—clear ownership, standards, and quality controls—is non-negotiable. Without clean, consistent data, analytics don’t matter.

From there, predictive analytics should be embedded directly into project workflows, not buried in reports. Tracking the right KPIs and using data to flag schedule, cost, safety, and resource risks early shifts teams from reactive to proactive.

Finally, this only works if people are brought along. Start small with high-impact use cases, involve field teams early, and invest in basic data literacy, so insights drive decisions—not just meetings.

RELATED: Five Key Challenges AEC Project Owners Face and How to Solve Them with Jama Connect®

Regulatory Changes

What upcoming regulatory changes or compliance requirements do you anticipate having the biggest impact on the AECO industry in 2026? How can companies stay ahead of these changes?

Gould: The biggest regulatory shifts hitting AECO in 2026 will center on ESG (Environmental, Social, and Governance), energy performance, and digital risk. ESG reporting is moving from “nice to have” to mandatory, with climate disclosure requirements cascading through supply chains. Energy codes will continue tightening, pushing firms toward higher-performance, low-carbon, and “zero-ready” buildings. At the same time, increased use of AI and cloud platforms is driving new expectations around transparency, governance, and cybersecurity.

The firms that stay ahead won’t treat this as a compliance exercise. They’ll lean on digital platforms to track energy, carbon, and materials from design through operations, put clear AI and data governance in place, and strengthen cybersecurity practices as reporting requirements tighten. Just as important, they’ll build regulatory awareness into project planning early—before requirements show up as cost, schedule, or risk surprises.

Cybersecurity in AECO

As digital tools and connected systems become more prevalent in AECO, what role do you see cybersecurity playing in protecting sensitive project data and ensuring operational continuity? Are there specific threats or solutions companies should prioritize?

Solis: As digital tools, connected platforms, and AI become more embedded in AECO workflows, cybersecurity will play a critical role in protecting sensitive project data and maintaining operational continuity. With the growing use of AI, firms must clearly define what data can and cannot be shared with AI models, particularly when working with proprietary designs, client information, or critical infrastructure data.

Beyond data leakage, organizations also need to address risks such as AI hallucinations, bias, and model misuse, which can directly impact design decisions, safety, and compliance if left unchecked. To mitigate these risks, companies should prioritize strong access controls, data governance policies, employee training, and secure AI deployments. Establishing clear guidelines around AI use, along with continuous monitoring and validation of outputs, will be essential to ensuring both cybersecurity and trust in digital systems as adoption accelerates.

Future of Innovation

What is the most innovative trend, tool, or process you’ve seen in the AECO industry recently? How do you anticipate it influencing the industry in the coming years?

Solis: One of the most impactful trends I’ve seen recently is the increased focus on Requirements Management across rail and broader AECO organizations. While this shift is often driven by hard lessons such as losing a contract or discovering unmet requirements late in a project, it signals a growing recognition that informal or disconnected requirement processes are no longer sustainable for complex, regulated projects.

Gould: The most meaningful innovation in AECO is the convergence of AI, digital twins, and integrated platforms. Together, they’re turning projects into connected, data-driven systems that move teams from static modeling to prediction, automation, and lifecycle optimization.

At the center is the digital thread. Requirements are no longer buried in PDFs and spreadsheets—they’re connected directly to BIM, schedules, costs, and real-time performance data. AI continuously validates designs against requirements, flags deviations early, and maintains traceability from concept through operations. That shift alone reduces rework, misalignment, and late-stage surprises.

AI-powered digital twins then extend this into delivery and operations, keeping stakeholders aligned and enabling smarter, faster decisions. The result is leaner execution, better compliance, and assets that actually perform as intended—not just on day one, but over their full lifecycle.

Long-Term Trends

What trends or technologies do you think will still be shaping the AECO industry five years from now? Ten years? How can companies position themselves to remain competitive in the long term?

Solis: I don’t think there’s one technology specifically that will shape the AECO industry. Companies who make an effort to welcome new technologies and not go against them will see success. This industry doesn’t want to evolve, but it will.

Gould: Over the next 5–10 years, AECO will be defined by digital maturity and industrialization. AI, BIM, and digital twins will move from tools to core infrastructure, while sustainability and offsite construction become standard, not optional.

In the next five years, BIM becomes the project command center—fully cloud-based and connected to schedule, cost, and lifecycle data. AI is embedded in planning and design to surface risk early, optimize decisions, and improve predictability. Modular and offsite construction scale quickly as firms respond to labor constraints and schedule pressure. Sustainability shifts from “nice-to-have” to a requirement.

Hard to say but looking ten years out I would predict that digital twins manage assets end-to-end, robotics handle more field execution, and buildings operate as connected systems within smart cities. Design, construction, and operations blur into a continuous, data-driven lifecycle.

The firms that win will invest early in integrated platforms, clean data, and workforce upskilling. They’ll focus on collaboration, specialization, and strong technology partnerships—turning digital capability into real project outcomes, not just innovation theater.